The landscape of cryptocurrency adoption is evolving rapidly, with significant strides being made in integrating digital currencies into traditional financial systems. One of the most groundbreaking developments in this space is the ability to pay taxes using cryptocurrencies.

Switzerland is at the forefront of this movement in Europe, setting a precedent that other nations are beginning to follow. This article explores how close we are to paying taxes in cryptocurrencies across Europe, examining the current state of adoption, regulatory advancements, and the implications for the future.

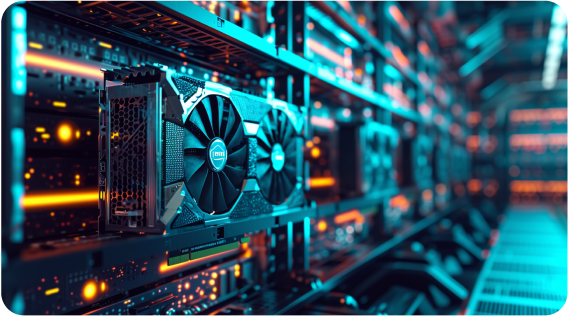

Cryptocurrency Integration in Traditional Banking

Integrating digital currencies, including cryptocurrencies, into traditional banking systems is accelerating, with Switzerland leading the charge in Europe. Residents in some Swiss regions can now pay their taxes using cryptocurrencies, a significant step in merging digital finance with established financial frameworks.

Switzerland: A Pioneer in Crypto Adoption

Switzerland stands at the forefront of this transition. Not only can Swiss residents use crypto for everyday purchases like coffee, but they can also pay their taxes with digital currencies. The Swiss Canton of Zug, often called “Crypto Valley,” allows residents to settle their income taxes using Bitcoin or Ethereum, showcasing a practical application of cryptocurrency in public finance.

European Union’s Regulatory Progress

The European Union is making strides to catch up with Switzerland. The Markets in Crypto-Assets Regulation (MiCAR) will come into effect on January 1, 2025, providing a comprehensive regulatory framework for crypto assets across member states. This regulation aims to enhance transparency, security, and consumer protection in the crypto market, facilitating broader adoption.

Customer Demand and Financial Institution Adaptation

Customers are growing increasingly demanding traditional banks offer cryptocurrency services. Similar to the shift from cash to credit cards and then to digital wallets like Apple Pay, the integration of cryptocurrencies is becoming a necessity rather than a novelty. This demand drives banks to explore ways to incorporate crypto services, ensuring they stay relevant in a rapidly evolving financial landscape.

Blockchain’s Role in Transparency and Efficiency

Blockchain technology, which underpins cryptocurrencies, offers significant advantages in transparency and efficiency. By eliminating intermediaries, blockchain reduces transaction costs and enhances security through decentralised cryptographic systems. This technology is more cost-effective and provides a transparent record of transactions, which is crucial for building trust among users.

Challenges and Regulatory Needs

Despite the progress, several challenges remain. Cryptocurrencies, by their nature, operate outside traditional financial systems, which can lead to volatility and regulatory complexities. For widespread adoption, cryptocurrencies must be integrated into existing financial systems with robust regulations to ensure safety and stability. This includes addressing anti-money laundering issues and knowing your customer requirements.

The Future of Crypto in Europe

As cryptocurrencies gain traction, more European countries are exploring their potential for various applications, including tax payments. Switzerland’s example provides a model for other nations, demonstrating the benefits of integrating crypto into public finance and everyday transactions. With the upcoming MiCAR regulations, Europe is poised to become a leader in the global cryptocurrency market, offering a more regulated and secure environment for digital assets.

The journey towards paying taxes with cryptocurrencies in Europe is well underway, led by pioneering efforts in Switzerland and supported by upcoming EU regulations. As more countries recognize the benefits of integrating digital currencies into their financial systems, the future looks promising for the broader adoption of cryptocurrencies across Europe. Coinsdrom continues to monitor these developments, providing users with up-to-date information and opportunities in the evolving crypto landscape.